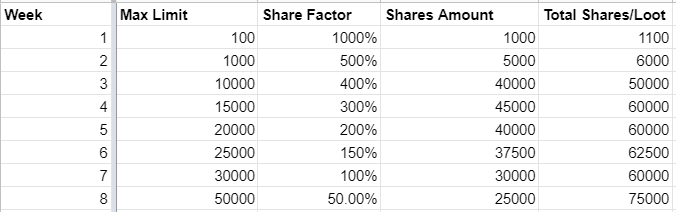

TL;DR: In order to allow immediate deposits into the dao bank, I am proposing a $100 wxDAI cap for week one. To reward these early, smaller contributions, they will be awarded a 10x voting reward. Each following week, this cap will be raised and the bonus will be lowered, allowing increasingly large contributions while balancing stakeholder interests.

Hello all and first off thanks a lot for being here. It’s an honor that you all have gotten behind this idea of a dao and I look forward to seeing how far we can roll with this. I am behind you 100%, and I am really enjoying meeting so many interesting people and can’t wait to see how things go over the next few months.

Ok, so we have a dao, now what? We need to figure out how we are going to build up the bank between now and week eight, which is when we’re supposed to have a go/no-go decision. I think it’s important for us to be able to show the broader community that our plan is safe, that everyone has a voice, and most importantly, that we’re going to succeed. I’m not sure how many entities are going to collect the full collection of NFTs, but I can’t imagine that it will be enough, and I think we can leverage the various rewards that we’ll get to come out of the gate running and dominate the mini-game in July.

Anyways, so my funding plan follows. We’ve got two conflicting goals here. One, raise money quickly, and two, protect the voice of smaller players who don’t have several grand to throw at this metaverse like some of us degens. On the one hand, we need to incentivize early contributors with some kind of boost, while on the other hand we need to grow slowly so that someone with a huge pool of capital doesn’t come over and run roughshod over us.

Here’s an example, these are example multipliers and limits, for discussion purposes. You can see the sheet here and make a copy to play with yourself.

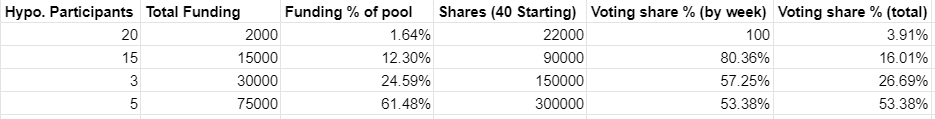

To see exactly what I’m trying to do here, I filled out more of the sheet with a hypothetical four week contribution schedule, based on the original survey results that we got last week. In this example, twenty people put $100 in the bank, fifteen put $1000 in week two, three put the max on week three, and five on week four. As you can see, while the five from week four have contributed 61% of the capital in the pool, but their percent of the voting shares has been limited to 53%.

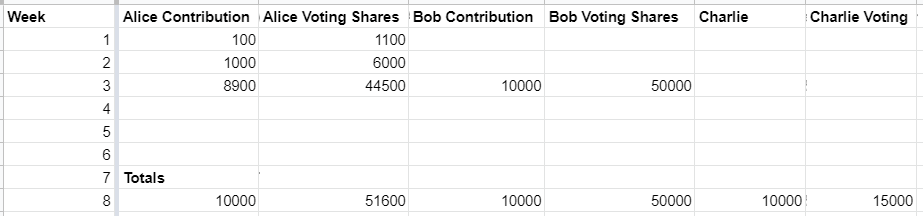

To show how this might work out on the individual level, let’s look at three people, Alice, Bob, and Charlie. They all have $10,000 that they want to invest in the pool.

- Alice spends $100 on week one, adds another $1000 on week two, and then puts the rest of her money, $8900, into the pool on week three. She now has 41,600 shares.

- Bob doesn’t get involved in the dao until week three, and he dumps all $10,000 in at once. He gets 40,000 shares. Slightly less than Alice but still pretty fair.

- Charlie on the other hand, waits until week eight and comes in with $10,000. He winds up with 15,000 shares.

As I said, these numbers are just hypothetical. We will not be able to predict future involvement eight weeks out at this point, so I would like feedback on where we start, with the knowledge that the we’ll need to make adjustments on a week to week basis. I think two or three days of discussion should be sufficient, then I expect we should be able to move forward with funding contributions.

Thanks all,

BCM | Dao Launch Control