Last week was relatively quiet, but we’ve got a lot going on this week in the Star Atlas Metaverse.

OFFICE HOURS

That’s right, we’re going to start doing office hours. The first one will be in the Interstellar Alliance Discord, this Tuesday, 1PM EST. I’ll answer any questions people might have about what we’re doing. This will be public, and geared toward non-members. I will also start doing one in our private server on Thursdays as well. I’ll try to schedule these during different times to accomodate people in Asia/Pacific.

PROPOSAL 190: Likewise Ventures Wallet acquisition

I will use the designation ‘P190 assets’ to refer to these moving forward. Everything has been moved to the ALPHA hotwallet for the time being while we figure out what we’re doing. All playable assets – those with in-game utility – will remain there for now. Only two of the cosmetics have been put up for sale, the skin and emote associated with the OPOD are up on the market, but they haven’t moved yet.

Personally, I think that we should hold onto the T3 Rebirth posters that we have, and I’d actually suggest that we should complete the set with the acquisition of the T0-2 posters. The capital needed is pretty low, and we’d have two complete T3 sets that might be subject to future ‘surprises’. Regardless, I am in no hurry to sell the posters since the treasury is flush with cash at the moment and I don’t have a mandate either way.

TRADE ACTIVITY

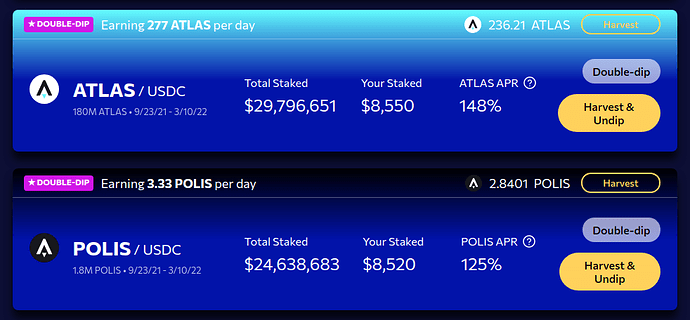

Besides the aforementioned OPOD posted sell orders, we did not purchase any NFT assets this week. We did continue our DCA purchase of ATLAS and POLIS on Sunday, which weree staked in Orca. Due to a mistake on my part, I purchased 2x the amount I was supposed too. Because of this, I’ll refrain from a purchase next week.

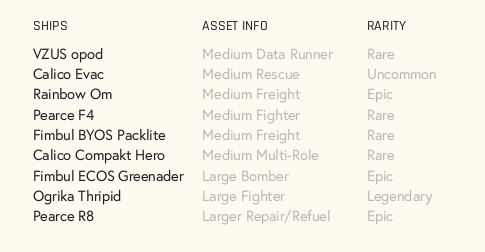

Since we do expect two new ships on the markets this Thursday, I would like to have a discussion about possible purchase.

It’s likely that we’ll be seeing the F4 and Greenader up for sale, and given what we saw with previous launches for the Thripid and Hero it’s likely that these will sell out. These aren’t going to be too expensive, so we could buy multiple and try to flip a bit. The downside to this is that it puts us at risk with regard to an inevitable C11 launch. We may find ourselves short on capital for the purchase if we overextend ourselves. Still, we have $133k in cash, which should be enough to buy the C11 and complete our A/P DCA plans, so I’ll do the math before the sale and will post results on Discord for a temperature check.

MEMBERSHIP

As of Today, Oct 4, 10:30 AM EST, DaoHaus shows 135 active members, 361,359 shares and 256,010 loot. We have six pending membership proposals with an additional 1600 shares, 7200 loot giving us a total of 626,169 claims, a 2.12% increase from last week.

We will continue the GAO r2 rate at this time, the econ group is still crunching the numbers and we may hold this rate while all that gets worked out.

TVL

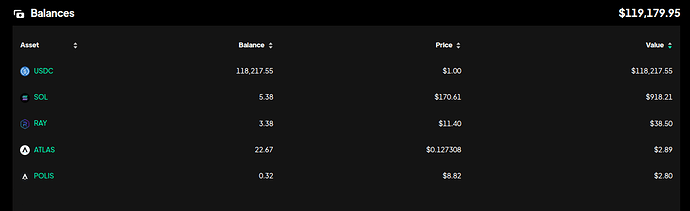

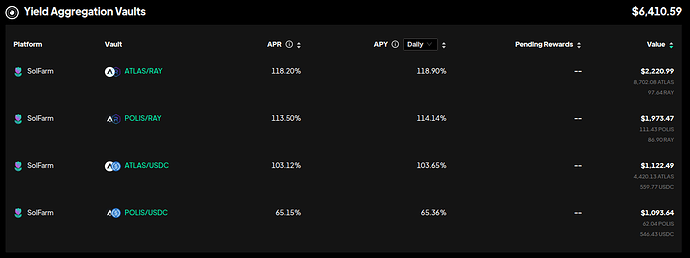

The breakdown of the SAIA.sol wallet is getting a bit harder to calculate these days, so here’s the breakdown:

14,160 in open DEX orders

For a token balance of 156820.54, an increase of 17.75% over last week.

The estimated market value of NFTS among all of the wallets under management is $196657.86, down 6% from last week. Asset prices are taken from the average price for the last twenty trades on the Serum markets. For illiquid assets a such as T3 Rebirth items, we use the last trade price listed.

This gives the dao a total TVL of $353478.4, up 3.23% from last week.

Estimated exit value for DaoHaus issuance is 0.564509581 (CASH + NFTs) / (SHARES + LOOT), a 1.09133% increase over the week prior.

TOKENOMICS

There is an ongoing discussion in the econ channel regarding tokenomics and distribution to members. The long of it is that we need to move away from DaoHaus, sooner than later, and move to a liquid token system on Solana. I won’t say too much here, but it looks like we will be breaking the ‘claim on bank’ that shares have, and make them vauleless governance tokens, while loot will effectively be valued at par based on the TVL of assets under management.

If we did this today, loot would effectively be valued at $1.3429520 based on today’s numbers, which is actually pretty close to the $2 purchase price that new members are buying in at. Last week would have been $1.355783147 for those wondering.

My working idea is to basically freeze new member contributions, snapshot the Daohaus, and mint 2x the amount of LOOT and SHARE tokens. We’d airdrop 4% LOOT to members’ wallets and put the rest in some sort of vesting time-release contract for a time TBD, possibly 18 months or so. Half of the tokens would be put in one of the vaults, minus 4% LOOT which we would either list on a DEX or AMM pool (on staratlas.exchange of course). If it’s an AMM then we can incentivise members to pool funds in exchange for SHARE emissions. We’d have similar bonuses for SHARE staking and LPs.

Generally speaking the dao’s SHARE treasury would be used for bounties and team compensation. Loot tokens could be used in a variety of ways, possibly to deal directly with large contributors as we scale up and move toward something like a series A round.

Obviously there’s a lot of technical components to work out here, smart contracts will likely need to be written or modified to implement the vesting and rewards portions. There’s also questions whether OGs like me and others would object to stripping SHARE of it’s claim on bank status. Personally I do not, since contributions have mainly been based on the LOOT side of the equation, with SHAREs as a bonus token. In fact I think this move is necessary to remove the ponzi-like aspects of new members inflating the exit value of older ones.

END NOTE

We’ve got several things going on with StarAtlas.Exchange; we’re preparing for the new releases on Thursday and we want to be ready for people to post buy orders. We have someone new onboard who is helping us automate the process so that we can stay in-sync with the official marketplace. I’ve also got some database migration tasks that I want to do to help us keep our costs down. I don’t anticipate the DEX being profitable in the near term, so I want to keep things down as much as possible.

We’ve also got ideas for a NFT project (who doesn’t these days heh) so we’re going to be taking a hard look at the Solana Metaplex project and figure out what we can do with that. It’s more of a side project and nothing is planned at this point though.

Overall, I’m continuing to level up my understanding of the Solana development stack while absorbing everything I can around Star Atlas. We’re still weeks away from the mini-game, and I’m sure we’ll make plenty of progress before we get there. And plenty of speculation in the meantime.

That’s it for this week, as always I’ll end by reminding everyone that this is a decentralized organization, so if you think there’s something that needs doing, get at it. Every member is empowered to help out wherever they like or take initiative as they see fit.

Long live the IA!

BCM | SAIADao Launch Control